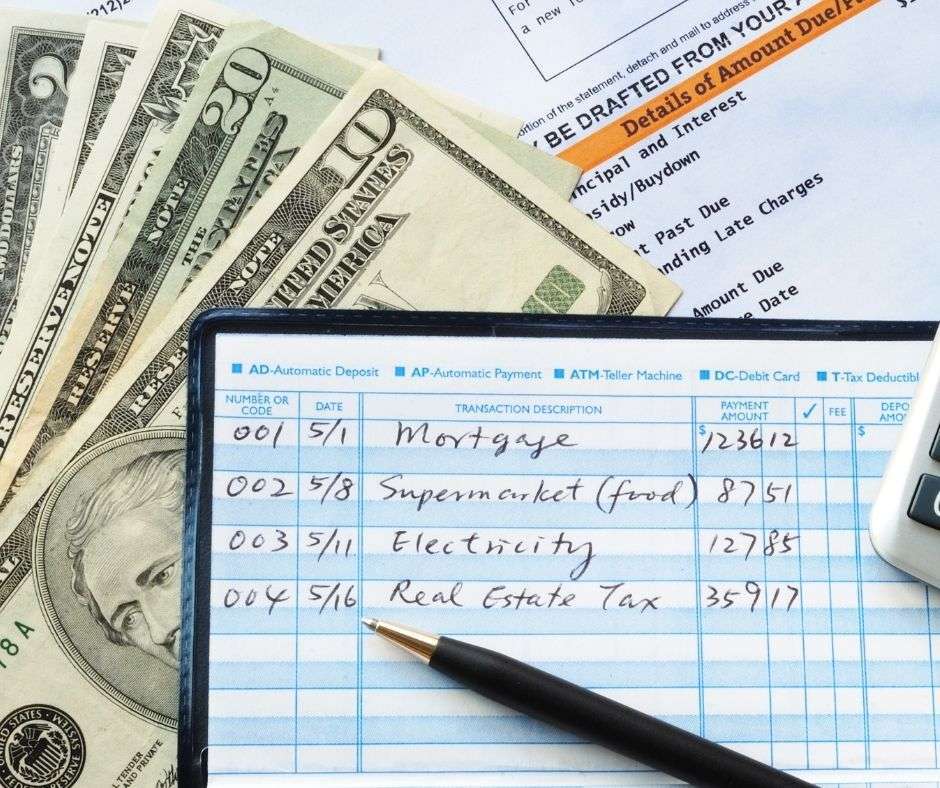

We have all of our monthly bills set up for auto-pay, but I do check my balance/bank account every day with their app just to make sure nothing is getting taken out that shouldn’t be. We only use checks in very rare circumstances which may just be the water bill. “What does balancing a checkbook even mean? (insert sarcasm) I have an app for that!” – Tiffany Even though we don’t write it down, we still keep track!” – Sara This helps us stay on track with the budget we set and what we save each pay period. “I don’t balance my checkbook, however, my husband keeps track on an app on his phone daily, and we are always in communication what all balances are at for our checking and savings accounts. I pay all of my bills at one time, and everything is charged to a credit card, so most everything is done online.” – Chelsey “I don’t – our water bill is the only thing that requires an actual check and it’s paid 4 times a year. However, I do monitor all my transactions online since so much of my spending is on my rewards credit card – just so I can catch something if a payment or account balance looks off.” – Emily “I write one check a month for rent, and all other bills are handled online, so I don’t bother balancing a checkbook. If we do write a check, it’s easy to see if it clears online.” – Lina “We write maybe one paper check a month, so no. I do keep a small list of the checks I write (and their numbers when I do have to write a check), so I know what to keep a lookout for when it clears online.” – Amber S. I always stuck to my Dad’s mantra – and while it won’t work for everyone, it has for me: Never spend more money than you have.” – Jamie So, now I know what balancing a checkbook is and so do you.Here’s why team members DON’T physically balance their checkbook: Therefore, it almost forces me to look at the balance and transactions on a regular basis so I don’t fall behind. I control my checking balance extremely tight because it doesn’t provide any interest.Look at every transaction and make sure it is accounted for. Look up the transaction history and make sure the records are correct.The less paper is used, the easier it is to keep track of our accounts. There’s almost no more reasons to write checks anymore with electronic bill pay. Here’s my version of balancing my checkbook and explains why I don’t need to balance my checkbook.

Okay, I’ve never done any of this but everything has been fine. In this day and age, all we need to worry about is the outstanding checks since all electronic transactions are recorded to our accounts instantaneously. Note: When I was reading different articles, I also saw authors mention about outstanding checks, ATM and debit card purchases. Basically, record all transactions related to the checking account including interest payments if there are any. Make sure to do the same with ATM and debit card purchases as well as ACH and wire transfers.Record all deposits and checks (the accounting term is reconcile but let’s just keep it in simple terms).So, the next question is – How do I write one? Here’s the answer. It is to also make sure our records are correct so we don’t write a check with money we don’t have as bounced checks means a $25 or more fee from the bank.Balancing a checkbook is to make sure our records matches the banks since they can make mistakes.Therefore, I did a bit of research on the topic and here’s what I found: I always heard that it was very important to balance my checkbook but I never bothered to figure out what the difference was between my checking account and my credit card transaction list since I can log onto both online and see all the transactions. I just realized that I never balanced a checkbook nor do I even know what balancing a checkbook is.

0 kommentar(er)

0 kommentar(er)